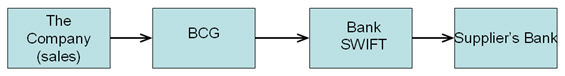

MONITOR contains a built-in feature that supports international payments to foreign suppliers using electronic transfers to the bank or post office. In order to send international payments electronically, your company must first have signed up for this kind of service with your bank or post office. If you will be sending international payments to the bank, it is important that the agreement includes transfers via the Bank Giro Central (BGC) and not just directly to your bank. See image.

Image of the flow of international payments.

In order to correctly address the payments to your supplier's bank, the bank system called SWIFT is normally used. The banks connected to this network have been assigned a unique SWIFT address. If you use this SWIFT address, the payment will be processed with greater speed and security. You can also address the payment with the bank's name in plain language, or send the payment by check directly to the supplier. However, if you state the bank's name in plain language, the payment will take longer and may also cause higher processing fees abroad.

The payments are exported from MONITOR as a payment file and will then be transferred via an external communication program or via the internet bank. The transfer takes place electronically via the internet bank or via internet-based communication programs, such as BGCOM, directly to the Bank Giro Central (BGC) or the PlusGiro (PG). These payments essentially function in the same way as your domestic payments to suppliers using the LB (supplier payments) and FB (invoice payment service) payment methods.

Unfortunately, the banks do not have a common or mutual standard concerning the format of the payment files sent to the banks. That is why MONITOR contains a built-in feature to manage payments to any of the following banks, as well as the PlusGiroo:

0 = PlusGirot

1 = SE-Banken

2 = Nordea

3 = Swedbank

4 = Handelsbanken

5 = Östgöta Enskilda Bank

6 = Swedbank in Latvia (adaptation)

7 = Nordea in Finland (adaptation)

8 = Nordea in Denmark (adaptation)

9 = Lithuania (adaptation)

10 = Samlink in Finland (adaptation)

Before you can start sending international payments electronically, you must configure certain settings and basic data for the suppliers registered in the system. These settings, as well as how to make international payments, are described in the following chapters: